Comun App is a financial service targeted to latino immigrants in the United States. This segment have long faced barriers when it comes to accessing banking services. Traditional banks often require a U.S. Social Security card or proof of address, which can be a significant hurdle for many immigrants. However, Comun Bank, a New York-based neobank, is changing the game by providing banking services tailored to the needs of Latino immigrants.

What is Comun Bank?

A New Era of Inclusive Banking

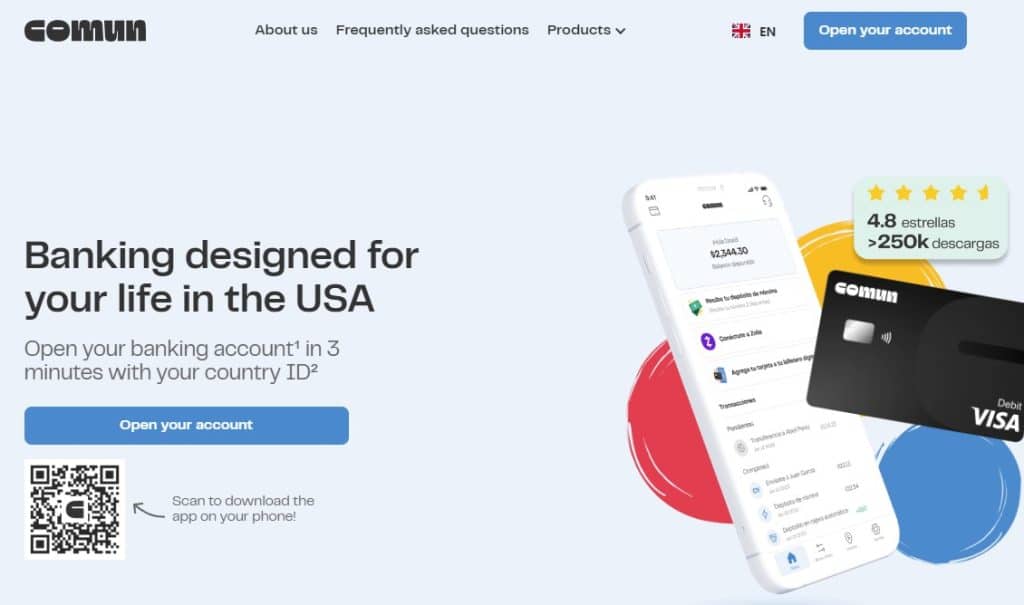

Comun Bank is on a mission to bring back local banking to immigrants in the U.S. Founded in 2021 by Andres Santos and Abiel Gutierrez, the neobank aims to provide digital banking services that cater specifically to the needs of Latino immigrants. With its mobile-first approach, Comun App offers instant payments, check deposits, and early paychecks, making it easier for immigrants to manage their finances.

Comun App: A Response to the Unmet Financial Needs of Latino Immigrants

The idea behind Comun App was born out of a need to address the financial exclusion faced by many Latino immigrants. According to Andres Santos, co-founder and CEO of Comun Bank, “Our mission is to bring back local banking to immigrants in the U.S.” By offering a range of services that are tailored to the unique needs of Latino immigrants, Comun Bank is helping to bridge the gap between traditional banks and immigrant communities.

The Unique Features of Comun Bank

Comun Bank: A Mobile-First Approach to Banking

Comun Bank’s mobile-first approach means that customers can access their accounts and perform transactions on-the-go. This is particularly useful for immigrants who may not have access to traditional banking infrastructure or may prefer the convenience of mobile banking.

No Hidden Fees, No Minimum Balance Requirements

One of the key features that sets Comun Bank apart from traditional banks is its lack of hidden fees and minimum balance requirements. This means that customers can open an account without worrying about being charged exorbitant fees or having their account closed due to low balances.

Personalized Customer Support in Spanish

Comun Bank’s customer support team is available seven days a week and provides personalized support in Spanish. This is a significant advantage for many Latino immigrants who may not speak English fluently or may prefer to communicate in their native language.

How Comun App is Revolutionizing Latino Banking

Breaking Down Barriers to Financial Inclusion

By offering a range of services that cater specifically to the needs of Latino immigrants, Comun Bank is helping to break down barriers to financial inclusion. According to TechCrunch, “Identification requirements, high fees and a language gap have long been barriers preventing some Latino immigrants from opening a banking account in the United States.”

“Financial Inclusion is a Human Right”: The Vision Behind Comun Bank

The vision behind Comun Bank is simple: financial inclusion should be a human right. By providing access to banking services that are tailored specifically to the needs of Latino immigrants, Comun App is helping to empower families and individuals who may have been previously excluded from traditional banking systems.

Empowering Latino Immigrants with Access to Credit and Financial Tools

| Feature | Description |

|---|---|

| Digital Banking Services | Instant payments, check deposits, and early paychecks |

| No Hidden Fees | No minimum balance requirements or hidden fees |

| Spanish-Language Support | Personalized customer support available seven days a week in Spanish |

| Credit Building Opportunities | Built-in credit building tools help customers establish credit history |

| Rapid Expansion Plans | New products and services planned for launch in coming months include insurance and credit underwriting capabilities. |

By providing access to credit and financial tools, Comun App is empowering Latino immigrants with the ability to build credit history and achieve financial stability.